A modern American granary

(Image Source) |

What are Commodity Buffer Stocks?

"Commodity Buffer Stocks" refer to the use of

commodity storage for economic stabilization. Specifically, commodities are

bought and stored when there is a surplus in the economy and they are sold from these

stores when there are shortages in the economy. The institutional buying,

storing and selling of commodities by a large player (e.g. a government) can take place

for one commodity or a "basket of commodities". The stock of commodities

stored act as a buffer against price volatility. If a basket of commodities is

stored, their price stabilization can in turn stabilize the overall price level. |

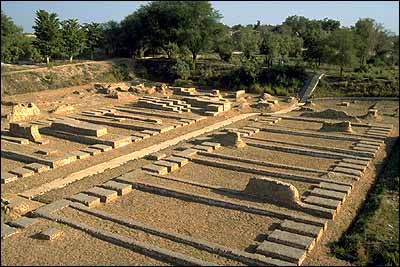

Granary of Harappa from

Indus Valley civilization (c.2600-1900 B.C.E.).

(Image Source) |

Storage and Stability - An Ancient Idea

The use of commodity buffer stocks against fluctuations, the idea of

an "ever-normal granary", is an ancient idea. For instance, the Bible (Genesis

41-47) informs us that the Egyptians operated an "ever-normal granary", storing

food during the seven years of plenty and then releasing these during the seven years of

famine. Classical China also operated commodity buffer stocks - particular under the

consolidation during the Sui dynasty in the 7th Century. There is also much evidence

that many other civilizations throughout the world have operated commodity buffer stock

schemes for economic stability. |

|

Relation to Agricultural Commodity Price

Stabilization

More recently, commodity buffer stocks have been used to stabilize agricultural

prices both within the United States and other developed countries as well as in many

developing countries and even across countries via international agreements.

Governments or marketing boards, for instance, store or encourage the storing of

commodities in the aftermath of bumper years and then release these stores during poor

harvests. In this way, the prices of agricultural commodities can be

stabilized and farmers can plan their activities with more confidence. |

|

What was Benjamin Graham's idea?

B. Graham, 1894-1976

The more general proposition of using a basket of commodities to stabilize output

and prices as a whole was set forth by Benjamin Graham in his

1937 Storage and Stability and elaborated later in his World Commodities and World Currency in 1944. In

the height of the Great Depression, when there was a "general overproduction of

goods", or a "general glut", Benjamin Graham felt that it was paradoxical

that these surpluses of goods which should be regarded as greater wealth, could also cause

so much damage and be feared so much. Commodities, after all, are an asset not a

liability. Instead of laying off workers, cutting back production and reducing

prices - all of which can cause terrible economic and social damage - Graham resurrected

the old idea of an "ever-normal granary" and proposed instead that firms could

maintain steady levels of production and that any general overproduction can be eliminated

by the storage of commodities. Conversely, during periods of

"underproduction", when inflationary pressures are high, the shortage of

commodities as a whole can be eliminated by releasing previously stored commodities onto

the market. Thus, in Graham's proposition, an economy-wide "ever-normal

granary" could stabilize output levels and prices, and thus smooth out the business

cycle, and thus eliminating unemployment and inflation. |

Image of Fortuna, goddess of plenty, on

a Roman denarius.

(Image Source) |

A Commodity-Reserve Currency

Benjamin Graham also proposed the adoption of a "commodity-reserve

currency". This would work effectively like a Gold Standard, except that

backing up currency would not be that single volatile commodity, gold, but rather an

entire basket of commodities. Gold and money fluctuate in their purchasing power of

staple commodities. The "gold reserves" which previously determined

the supply of money in the Gold Standard would be replaced with the very

"commodity reserves" of the ever-normal granary, thus anchoring the money supply

to real purchasing power, impervious to political manipulation (as in the modern system)

and far more stable than a single commodity (as in the Gold Standard). |

Friedrich A. von Hayek

Nicholas Kaldor, 1908-1986 |

What happened to Benjamin Graham's propositions?

Benjamin Graham's 1937 and 1944 books received a considerable amount of attention

and support by leading economists such as John Maynard Keynes, Friedrich A. von Hayek,

Milton Friedman and Frank D. Graham. However, policymakers were reluctant to abandon

the old mystical idea of a gold-backed currency with a commodity-backed currency -

particularly when international agreement was necessary to make the plan effective.

The storage idea, as we noted, has been used extensively in particular commodities like

coffee, tin, and tobacco. But not to the macroeconomy as a whole. Demand

management and politically-controlled money supply has been the norm since the beginning

of the Keynesian era - even though Keynes himself was quite supportive of Graham's ideas

on storage (albeit not on currency).

The famous Cambridge economist Nicholas Kaldor resurrected Graham's ideas in the

1960s, calling for an international commodity-reserve currency - which he called

"Bancor" - based on commodity storage, emphasizing its power to assist commodity

export-dependent developing countries. Kaldor reiterated his call for Bancor

after the unravelling of the Bretton Woods agreements in the 1970s. Modern

economists, such as Robert E. Hall and Leland Yeager, have continued to propose various

aspects of Graham's scheme and the recent resurgence of interest in "sound

money" and economic stability, particularly in light of the Asian Crises of 1997-8

and the Euro experiment, make it as urgent and pertinent as ever.

|

|

![]()